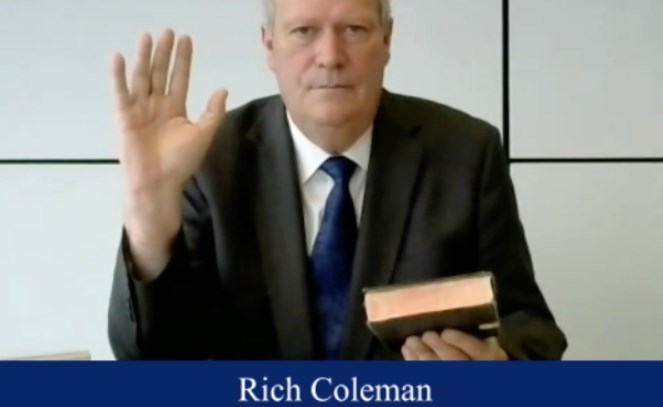

Former deputy premier Rich Coleman maintained his position at a public inquiry into money laundering in B.C. that efforts to curb criminal activity in regulated casinos were never undermined to maintain what became a fast growing revenue stream for his government.

“I never saw any attitude within government that you need to let questionable money flow into any aspect of government,” Coleman told Brock Martland, counsel for the Commission of Inquiry into Money Laundering in B.C.

“The need for revenue was never a driver for anything we did on this file,” he said.

Over his close to five-hour testimony, Coleman, an MLA between 1996 and 2017, described his role as a primary architect of expanding gambling under the BC Liberal government commencing in 2001. Coleman was responsible for gambling policies and enforcement on three separate occasions (2001-2005, 2008-2010 and 2012-2013), during which time it is now known large and suspicious transactions reached hundreds of millions of dollars annually despite being illegally underreported by casinos for many of those years.

Under oath, Coleman explained perhaps one of his most controversial decisions as the minister responsible for gambling – the disbandment of the Illegal Gaming Enforcement Team (IGET) in 2009.

IGET was tasked in 2004 by Coleman to conduct investigations outside of casinos, but Coleman determined it was ineffective and the RCMP understaffed it – although he said he never consulted with the RCMP on the matter and his director of police services at the time, Kevin Begg, never made such a recommendation. Rather, Coleman said he understood the Treasury Board would not have continued funding IGET.

The team’s then officer-in-charge Fred Pinnock previously testified he warned Coleman of organized crime in casinos. It would later be shown at the inquiry, via police testimony, that these crime networks used illegal gambling houses in Metro Vancouver as part of their alleged casino money laundering operation. The situation would soon balloon into a transnational organized crime operation.

Coleman refuted Pinnock’s testimony that he was dismissive toward Pinnock’s concerns. He also refuted testimony from former Gaming Policy and Enforcement Branch (GPEB) director of investigations Larry Vander Graaf, who claimed he warned Coleman of money laundering.

Coleman also downplayed media reports on the issue around 2010, stating news articles must be weighed against what cannot be reported.

But Coleman also dismissed RCMP inspector Barry Baxter’s concerns and assessment of money laundering activity, according to Baxter’s prior testimony. Baxter was in charge of the B.C. unit of the Integrated Proceeds of Crime (IPOC) unit, which appeared to take over illegal gambling files after IGET was disbanded. IPOC was shut down as well under Coleman’s watch, although the inquiry has heard this was a federal decision.

In a period in which Coleman wasn’t in charge of gambling, from late 2010 to early 2012, then-executive director of civil forfeitures Robert Kroeker produced a report wherein he made 10 recommendations, including the re-formation of an illegal gambling police unit.

Coleman was asked why it took until 2016 to have the Joint Illegal Gaming Investigation Team created. He said putting together those units is complex, although Martland noted his cabinet colleagues said it was a quick process by the time the decision was made (well into a full-blown, high-level RCMP investigation dubbed E-Pirate).

At any rate, Coleman said more money was being invested in gang units, so he felt he wasn’t under resourcing police.

Martland showed Coleman a number of briefing notes Coleman would have used in Legislative debates. One stated the Kroeker Report “findings were publicly released last August, revealing that the province already has a robust anti-money laundering [AML] regime.”

Martland asked if this was more “spin” than fact, but Coleman said it was not so.

“These documents seem to put forward a positive picture as to BCLC’s AML efforts,” suggested Martland.

Coleman replied that the B.C. Lottery Corp. (BCLC) board always assured him the AML regime was working.

But reports of bags of $20 bills totalling hundreds of thousands of dollars were being made by GPEB around 2010, and they continued until 2017 when the BC Liberals lost power.

Coleman was presented a past email from an apparent whistleblower, who described Edgewater Casino VIP hosts working in concert with loan sharks.

“Management knows who they are and who’s doing it but does nothing about it,” the email to Coleman stated.

Coleman explained he would have sent the email to the proper authority.

The notion that regulated casino employees may have been working with loan sharks has been raised a number of times at the inquiry.

As far as government workers and politicians go, the inquiry hasn’t produced any evidence that shows anyone in government wilfully ordered casino investigators or police to stand down due to revenue concerns. However, some casino investigators have accused BCLC officials of being more concerned about revenue than social responsibility, when the two must be delicately balanced.

Documents showed at today’s hearing indicated gambling revenue went from about $880 million in 2005 to $1.6 billion in 2012. BCLC officials received personal bonuses for achieving their revenue goals, the inquiry has heard.