Twenty-one Cowichan Lake-area homeowners have won $10.5 million in rollbacks on their property assessments, saving them thousands of dollars in taxes.

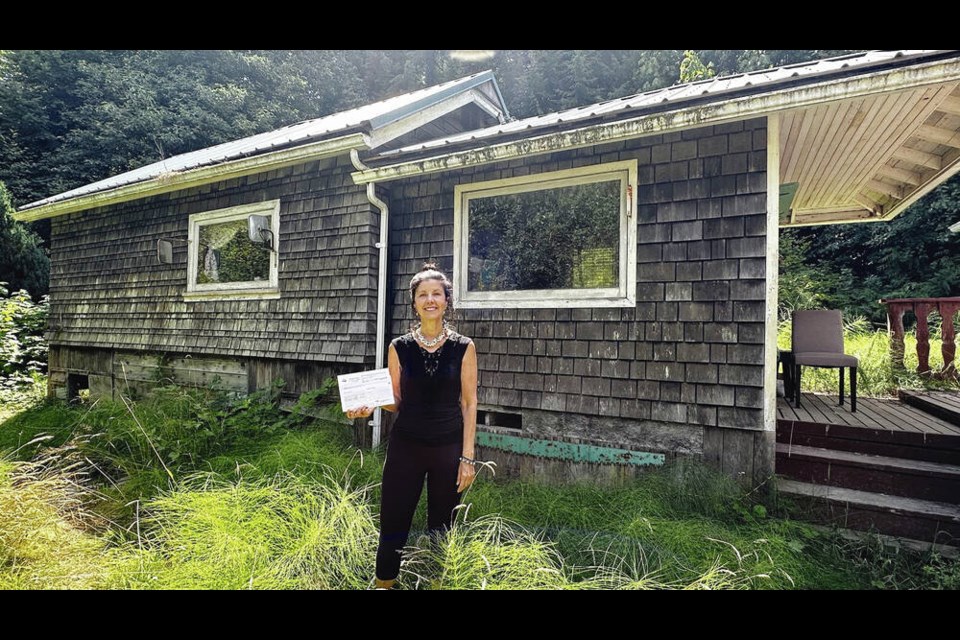

Shelley Robinson, who has a modest home at Honeymoon Bay, saw her 2023 assessed value drop to $1.056 million from $2.234 million after appealing to the Property Assessment Appeal Board of B.C. “It’s going to make all the difference to me,” said Robinson, who is expecting a tax refund of almost $6,000.

Robinson, whose 2024 assessment is $1.088 million, said she considers the revised value fair for the half-acre property close to the water.

She said she grew up in the house, which was built by her father in the late 1940s, and had feared that she might be forced to sell it because of high taxes.

Robinson is one of 25 property owners in the Cowichan Lake area who went through B.C. Assessment’s appeal process, which she called a difficult and “tumultuous” process.

“I put hundreds of hours into this.”

One of her concerns is that B.C. Assessment staff presented photographs of the property that were 30 years out of date.

She praised Jason Anson, a local real estate agent who donated his time in the past year to support the owners in their appeals. “I could not have done it without Jason.”

The highest-value house in the group was initially assessed at $3.7 million but that was reduced to $2.5 million on appeal, Anson said.

Group members first went to the Property Assessment Review Panel, and when they weren’t successful, moved to the next level, the Property Assessment Appeal Board of B.C.

The appeal board agreed to reduce assessments for 21 of the 25 properties, notifying owners this week.

The four property owners who did not receive any assessment reduction have the option of appealing to the Supreme Court of B.C.

One of those owners, Andy Ross of Youbou, said he has no plans to give up the fight.

“I’m definitely going to go to the Supreme Court on this,” he said Friday. “It’s win or lose. I don’t think I’ll lose.”

Ross and wife June Curran live on a lakefront property in Youbou in a house they partly built themselves that’s assessed at $2.34 million. While the board didn’t reduce that assessment, it cut the assessed value of their neighbouring vacant lot to $477,500 from $605,000.

The lot with the house does not have walk-in access to the water because it had to be raised a number of years ago following a flood, Ross said.

Floyd Augustine, 86, had more success in challenging the $2.136 million assessment for his Youbou home, which he purchased for $4,000 in 1960. The former mill worker was pleased to hear that his assessment had been reduced to $1.5 million and he can expect a tax refund of about $3,000, Anson said.

Augustine had said last year that his pension was not keeping up with the cost of living and he was worried about rising property taxes.

Total reductions in property taxes among the group that appealed will be close to $50,000, said Anson, adding thousands of pages of documentation were required for the appeals.

Ben Mittelsteadt, B.C. Assessment communications manager, had no immediate comment on the new assessments, saying the office had just received the appeal results and needed time to review.

He noted that some of the properties are under appeal again and B.C. Assessment can’t comment on active appeal cases.

Anson said that appeals were initially dismissed by the Property Assessment Review Panel without a review of the homeowners’ evidence or a hearing.

He said the situation underscores the need for a reassessment of the entire area to ensure fairness and accuracy in property valuations.

B.C. Assessment used unreliable third-party information for its assessments, he said. The new computer system it switched to a couple of years ago has experienced difficulties in importing accurate data from the land title office, Anson said.

Assessments are based on a property’s value in the summer of the previous year.

>>> To comment on this article, write a letter to the editor: [email protected]