While property tax season may seem a ways off, Bowen Island Municipality is in its annual multi-month budget process where staff and council examine priorities for the years ahead.

Dec. 7, councillors got a rundown of budget pressures from the man behind the calculator – chief financial officer Raj Hayre.

The CFO laid out options for tax increases – options that range from 5.1% to 15.5%. The recommended scenario at this point is a 6.6% tax increase for 2021. But, as staff and councillors repeated many a time, no decisions were made Monday. The proposed budget and community consultation is still to come.

Starting on capital reserves

BIM’s infrastructure – its roads, trails, culverts, buildings, water systems, any physical assets – is paid for through reserves, taking on debt (like with the fire hall and community centre) or grants.

About a decade ago, BIM built asset renewal into taxation. So every year, a 1.5% tax increase feeds a reserve fund. BIM draws from that fund to maintain Bowen infrastructure and there’s nearly $3.3 million in that fund now.

If BIM replaced and renewed everything requested for 2021, it would spend nearly $4.8 million, said Hayre. There’s not enough money in reserves and taxes for that.

Hayre is proposing raising the annual capital reserves tax increase to 2%. Then, by deferring some projects and seeking other funding (grants and borrowing), BIM could manage a renewal and replacement budget of $2.3 million for 2021, he said.

This comes with the caveat that pushing spending comes with its own risks.

“We went through a prioritization exercise of deferring works based on risks to the municipality and risks of not doing that work,” said Hayre. “And then I also looked at other funding alternatives.”

Among the spending contortions Hayre mentioned:

- Doing half of the $700,000-$800,000 culvert work needed

- Using five-year equipment financing (borrowing) to fund the $640,000 fire truck

- Roads renewal spending of $400,000 rather $700,000

- Deferring a couple of large projects

New projects, like the composting facility, that come from grant funding and borrowing, are separate from the type of work listed above.

The water and sewer districts are also funded differently. (That’s a whole other story).

The process

BIM approached this year’s budget development a little differently from years past, said chief administrative officer Liam Edwards. There was more one-on-one discussion with department managers and they looked at areas in need of attention, particularly when it came to appropriate fees and charges for services.

“What we’re providing with council here today is a list of the highest priority items identified by each department,” said Edwards. “The needs are long and there are many but it’s not to say that everything has to be done in 2021. There are opportunities to defer some of those needs.”

“I also want to acknowledge that we recognize that this past year has been an incredibly difficult year for many Bowen Island residents, if not all, as well as Bowen businesses,” said Edwards. “We’ve taken these challenging situations into mind as we develop this budget.”

The operating budget

The operating budget includes wages and salaries, insurance, contracts for services, supplies, debt servicing, community grants and the money that’s then transferred to reserves.

Pressures on next year’s budget include:

- A 1.8% tax increase for cost of living adjustments for employees. This increase was cut at the 11th hour in 2020 as BIM found ways to slash the tax burden in light of the pandemic.

- A 1.8% tax increase for insurance, legal services, supplies and maintenance (some of the spending in this section has been offset by new taxable properties and development fees – the 1.8% is after the offset).

- An 8.6% tax increase for 6.9 new FTEs (FTEs are equal to a percentage of a full-time job – 6.9 FTEs is equivalent to 6.9 full-time jobs.).

- A 1.7% tax increase in council strategic initiatives (services not funded elsewhere but council wishes to fund –– the asset management plan and short-term housing initiatives are examples Hayre gave).

- And the 2% increase for capital reserves.

The above priorities total $863,000, a 15.5% tax increase. That’s an additional burden of $380 a year for the average household assessed at $1,083,000.

But that’s a little high for a tax increase.

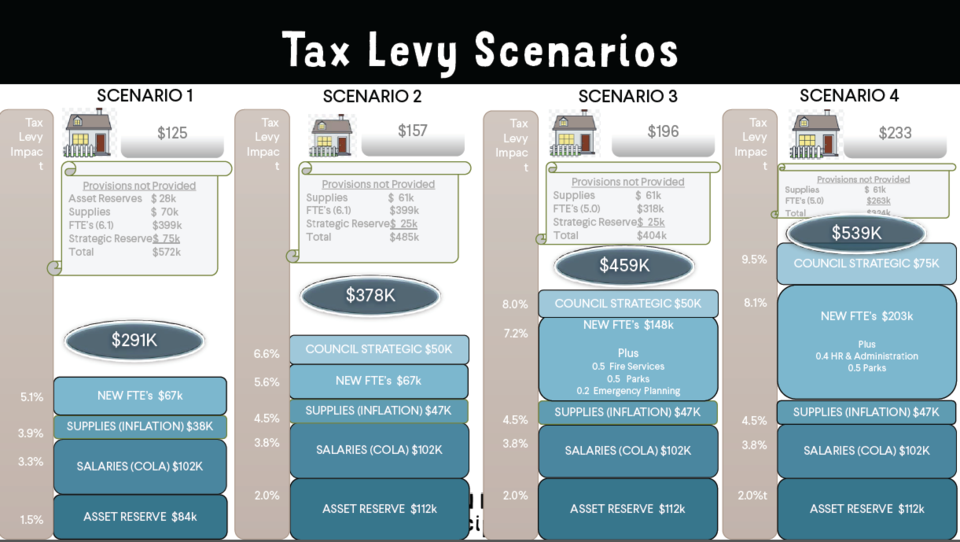

CFO Raj Hayre presented four tax increase options for the 2021 budget (besides the 15.5% outlying option). (Bowen Island Municipality graphic)

CFO Raj Hayre presented four tax increase options for the 2021 budget (besides the 15.5% outlying option). (Bowen Island Municipality graphic)Carving down the priorities and presenting options, Hayre recommended a 6.6% increase for 2020 that includes:

- $112,000 for capital reserves (2% increase)

- $102,000 for staff cost of living adjustments (1.8% increase)

- $47,000 for insurance, legal services, supplies and maintenance (.7% increase)

- $67,000 for new full-time equivalents (1.1% increase) this includes a part-time human resources position and increasing hours for a bylaw position

- $50,000 for council strategic initiatives (1% increase)

Edwards said the new part-time human resources position came out of an all-staff survey over the summer. “That was a very clear and strong request from all staff to get a dedicated HR resource,” he said.

The bylaw funding is to make the second officer full-time. “In my short time here, I have noticed a tremendous amount of activity in the bylaws department,” said Edwards. “We only have less than two staff and complement allocated to it. But yet, the amount of time that bylaw services requires is dramatic.”

Councillors noted that the public is likely to react to the idea of more FTEs.

Edwards pointed to a lower staff per capita ratio than neighbouring communities. “We are quite lean in comparison to some of our neighbour communities but yet the expectation of the level of service is quite high,” said Edwards.

Coun. Alison Morse noted that comparisons with other communities must be done with care as some don’t do their own recreation or do have paid firefighters.

“The pressure is on the operations of our core services around utilities, roads, parks, fire, that’s where the pressure really lies,” said Edwards. “Where we’re really feeling the pressure is from demand from the public to have adequate levels of service and higher levels of service.”

Other tidbits

Coun. Maureen Nicholson asked Hayre about the $1.2 million in COVID-19 relief funding received last month.

“What we’re talking about [in the operating budget] is ongoing costs of providing services,” said Hayre. “We shouldn’t be using a one-time grant or funding source to fund those types of requirements, because it’ll just add on to the pressures in subsequent years.”

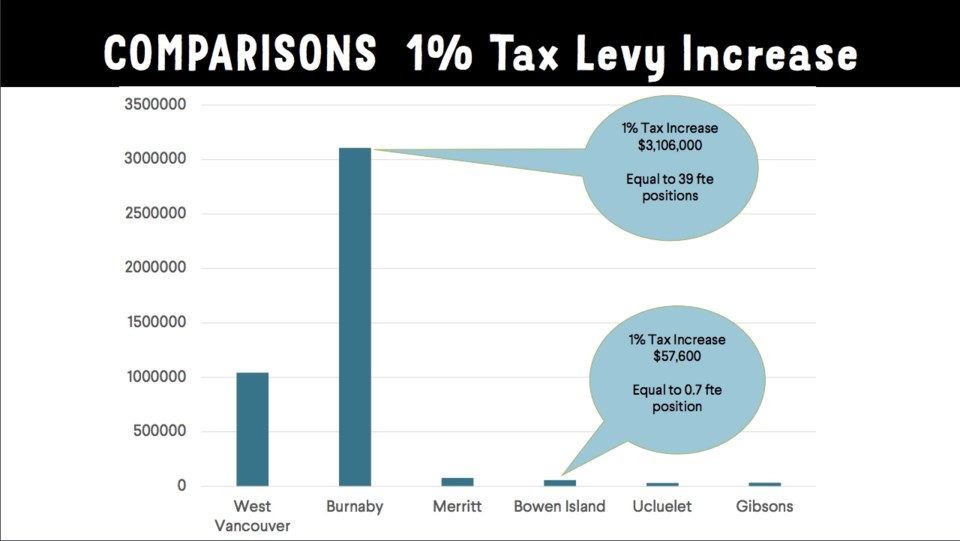

Hayre compared a 1% tax increase on Bowen ($56,700) with municipalities like Burnaby ($3,106,000) or West Vancouver (more than $1 million).

A percentage tax increase on Bowen Island compared with a percentage increase in other municipalities. (Bowen Island Municipality graphic)

A percentage tax increase on Bowen Island compared with a percentage increase in other municipalities. (Bowen Island Municipality graphic)

Hayre mentioned that external agencies (TransLink, schools, Islands Trust and such) represent usually about 50% of Bowen Islanders’ tax bills.

Watch the committee of the whole meeting on BIM’s YouTube channel: