Metro Vancouver has voted for aggressive increases on its development cost charges (DCCs), raising the ire of developers.

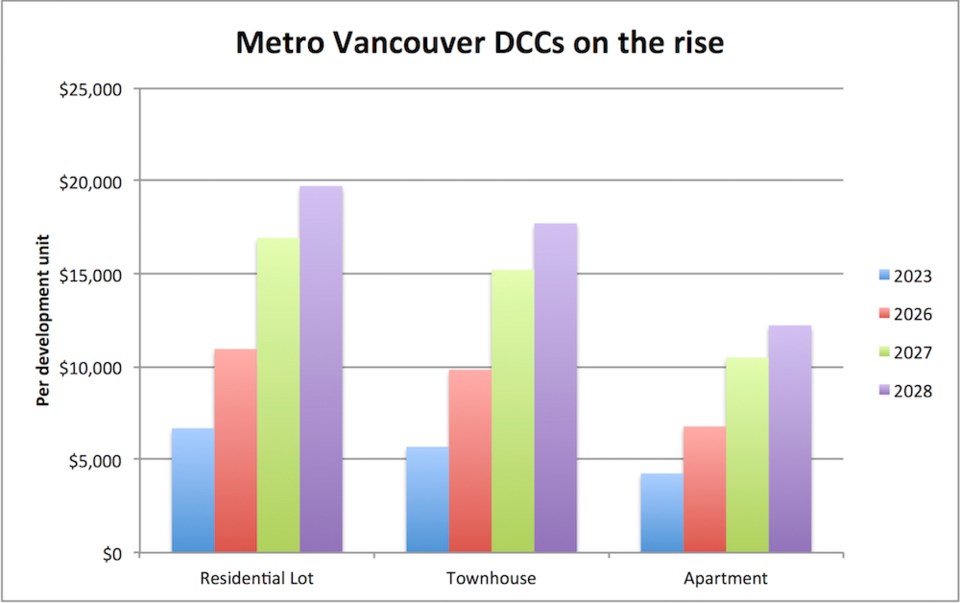

Current rates are set to soar by as much as 73 per cent from current levels in 2026 as a result of amendments passed Oct. 27 to the existing bylaw, signed just a year earlier.

Townhouses, long seen as being in short supply, will be hit hardest, with rates increasing 73 per cent to $9,839 per unit in 2026. Detached homes will increase by 64 per cent, to $10,952 a unit.

DCCs for apartment units will rise 59 per cent to $6,791 per unit, slightly more than the 56 per cent increase non-residential construction faces that will see office and industrial space charged $5.30 a square foot.

Within the space of five years, the increases will triple what developers pay Metro Vancouver to undertake construction, adding to uncertainties as builders pause projects while navigating higher financing costs.

Garry Fawley, CEO of Denciti Development Corp., which has pursued both industrial and residential projects, criticized the sudden nature of the increases that makes it hard for developers with multi-year development timelines to plan for increases even if they’re delayed for two years.

“There is a growing call for a more consistent strategy for DCC increases,” Fawley said, noting that the approach has been encouraged by the Urban Development Institute and others. “This strategy includes fixed-schedule reviews, phased approaches, enhanced reporting and accountability, and a standardized consulting process.”

Given the aggressive housing targets the province expects municipalities to achieve, and federal ambitions to boost the supply of affordable housing, Fawley pointed out that aggressive DCC increases are unhelpful.

“It’s essential to emphasize the role that developers play as partners in addressing the region’s housing shortage and affordability challenges,” he said. “A more measured, predictable, and collaborative approach to housing policy is the fastest way to get more housing built.”

The fees technically fund the cost of infrastructure needed to support new housing, but the impact goes well beyond infrastructure costs.

Canada Mortgage and Housing Corp. reported last year that government charges in major metropolitan regions across Canada last year contribute to less affordable housing.

While municipalities in Greater Toronto topped the fee charts nationally, with government levies adding up to more than $100,000 per unit in many cases, the average fee per high-rise condo unit in Vancouver led B.C. at $92,656.

Burnaby led the way with charges for row housing at $70,202 per unit, while Township of Langley delivered the most pain to developers of detached housing at $36,965 per unit.

A study the Urban Development Institute released earlier this year found that government charges account for close to a third of the rent a resident of a new woodframe purpose-built rental unit pays and 29 per cent of the cost of a woodframe condo unit.

Prior to the vote, the federal government warned Metro Vancouver against increasing its DCCs.

“I appreciate that cities need access to funding to build out the infrastructure that the growth we are trying to incentivize will rely on. I am not suggesting that development charges, generally speaking, are unacceptable,” federal Housing, Infrastructure and Communities minister Sean Fraser wrote Metro Vancouver directors. “I am concerned that at this particular moment in time, a drastic increase in development charges will inhibit our ability to seize the opportunity to incentivize a rapid increase in construction.”

Fraser urged Metro Vancouver to delay implementation and consider waivers for certain types of construction, particularly rental and non-market units.

Urban Development Institute president and CEO Anne McMullin was not immediately available for comment on the change.